how much is inheritance tax in georgia

State inheritance tax rates range from 1 up to 16. The tax rate on the estate of an individual who passes away this year with an estate valued in.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

. Georgia does not have any inheritance tax or estate tax for 2012. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206.

The following information is required. As of 2014 Georgia does not have an estate tax either. Due to the high limit many estates are.

Completed and signed MV-1. It is not paid by the. The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800.

However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. Who has to pay. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

No estate tax or inheritance tax. The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes. Estate and gift taxes the.

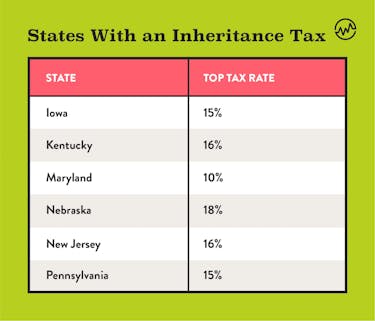

As of 2021 the six states that charge an inheritance tax are. Inheritance - T-20 Affidavit of Inheritance required. No Georgia does not have an inheritance tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Titles and tags can be obtained at your County Tag Office for a vehicle that has been inherited or purchased from an estate. Georgia law is similar to federal law.

The tax is paid by the estate before any assets are distributed to heirs. Georgians are only accountable for federally-mandated estate taxesin. These states have an inheritance tax.

Inheritance tax rates differ by the state. No estate tax or inheritance tax Hawaii. The top estate tax rate is 16 percent exemption threshold.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Georgia Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Studies In The Regulation Of Economic Activity A Voluntary Tax New Perspectives On Sophisticated Estate Tax Avoidance Paperback

Georgia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Your Inheritance Considered Taxable Income H R Block

Estate Tax Rates Forms For 2022 State By State Table

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Is Tax Liability Calculated Common Tax Questions Answered

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax Here S Who Pays And In Which States Bankrate

What You Need To Know About Georgia Inheritance Tax

Eight Things You Need To Know About The Death Tax Before You Die